Consumers do not change how they pay just because technology improves.

They change when they gain an advantage, whether that is easier, cheaper, or simply ‘better’. Some may also highlight “trust,” but that is a hygiene factor, not a motivator.

Until recently, crypto payments did not meet this standard. They were more difficult, slower, clunkier, and intellectually more challenging than cards and cash. Paying with crypto felt like hard work, and adoption was lacklustre as a result.

This is changing. As William Gibson (he who invented the term “cyberspace”) said, “The future is already here, it is just not very evenly distributed.”

What has changed is not only belief. Crypto is now usable and simpler – and never more relevant. Crypto payments are finally reaching a point where, in specific contexts, they are simply a better way to pay, both online and in the physical world.

And that is when behavior shifts.

Why consumers will actually choose to pay with crypto

The reasons consumers pay with crypto are not universal. They vary by region, transaction value, and context.

In some markets, inflation or currency controls dominate. In others, cross-border friction or access to banking matters more. For high-value purchases, control, certainty, and reversibility are important.

But the hardest – and the most important case to win for volume – is low-value, everyday, high-frequency transactions, like coffee, groceries, transport, and general retail. This is where cards and mobile wallets already work extremely well, so the bar for replacement is high.

For these transactions, ideology is irrelevant. Only a small set of benefits matters.

- Speed without friction. Everyday payments must feel instant and interrupt-free: initiate, confirm, done. When crypto matches or beats contactless flows, resistance drops quickly.

- Simplicity over novelty. Consumers will not accept extra steps for low-value high-frequency purchases. Wallets, on/offboarding, and authentication must fade into ultimate simplicity. If paying with crypto feels “different” it fails.

- Predictable cost. Small pricing surprises erode trust at high frequency. Stablecoin payments make the cost explicit at the moment of payment. What you approve is what you pay.

- Reliability everywhere. Habits depend on confidence. Crypto payments work when they behave consistently across locations, devices, and merchants.

- Security without anxiety. High-frequency payments increase exposure. Consumers care less about cryptography and more about clear confirmation, recovery, and familiar security cues.

- Subtle incentives, not evangelism. Modest discounts, faster refunds, or simple loyalty benefits can reinforce behaviour once the experience is already smooth.

None of this requires consumers to care about crypto itself. In everyday use, success looks boring: just another fast, trusted way to pay that happens to offer consumers real, understandable and tangible benefits.

When crypto wins here, at the lowest-stakes and most repetitive moments of commerce, it stops being an alternative and starts becoming mainstream.

Why merchants will actively support consumer crypto payments

Merchants do not adopt payment methods to be progressive. They adopt them because those methods improve outcomes.

The most immediate benefit is risk reduction. Crypto payments materially reduce chargeback exposure. Once a transaction is final, the economics of fraud change. That matters most in high-volume categories where abuse is common, margins are thin, and dispute handling is a hidden operational cost.

Fees are the next driver. Even small reductions in payment costs compound quickly at scale. When consumers pay with crypto directly, particularly at the point of sale, merchants avoid layers of interchange, scheme fees, and processor margins. That releases value (which is currently absorbed by intermediaries) back into the customer-supplier relationship, rather than the retail ecosystem itself.

That liberated value has two paths. In competitive markets, it flows back to consumers through sharper pricing, better offers, or improved service. In less competitive categories, it strengthens the merchant’s bottom line. In both cases, the beneficiaries are the parties actually involved in the transaction, rather than the infrastructure surrounding it.

There is also a working capital effect. Faster and more predictable settlement improves cash flow and reduces reconciliation overhead. For everyday retail, where volume matters more than ticket size, this translates directly into operational efficiency.

Beyond economics, there is strategic upside. Accepting crypto creates a more direct relationship between merchant and customer, without card networks sitting in the middle. That enables simpler loyalty, faster refunds, and more flexible post-purchase engagement, without ceding control to third party intermediaries.

In physical retail, and particularly in emerging markets, crypto payments are increasingly seen as an alternative wallet rather than a novelty. Scan, approve, done. No signatures, no terminal quirks, no regional inconsistencies. Once the flow is familiar, the distinction between “crypto” and “contactless” fades quickly.

For merchants, that is the point. Crypto does not need to be a statement. It just needs to move money with less leakage and keep the value where commerce actually happens.

What changed in the last 12 months to unlock this

The biggest shift is that stablecoins made crypto boring. In the best possible way.

Price volatility was the single biggest blocker for consumer payments. Paying £4.50 for a coffee today that might end up costing you £45.50 next month is not a rational proposition. Stablecoins removed that problem. Consumers can now hold and spend digital value without taking extraordinary currency risk.

Wallet user experience has improved materially. Payments are faster. Authentication is clearer. Recovery and device change flows are no longer catastrophic events. The experience is still imperfect and still requires some new knowledge, but it is now comparable to early mobile banking rather than experimental software.

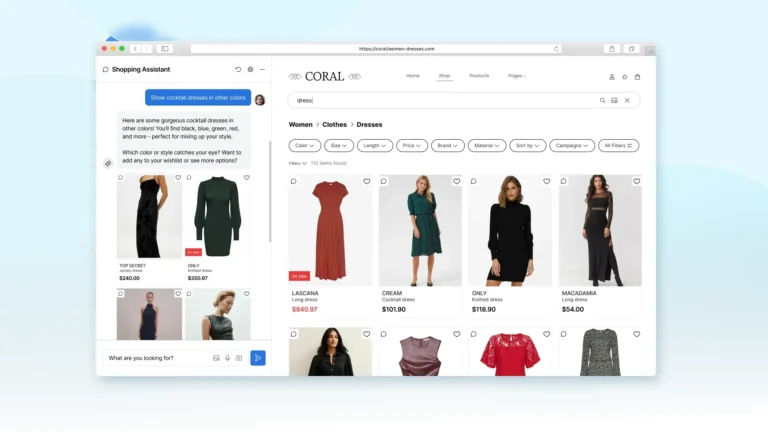

Point-of-sale and online acceptance infrastructure are maturing. Crypto payments are no longer confined to niche merchants or specialist hardware. They are increasingly integrating into existing checkout and terminal flows, which matters far more than any standalone crypto app. Acceptance at the point of sale is key.

Trust has evolved as well. Trust has improved through familiarity, even if you might be surprised at how trusting large populations without technical knowledge can be. As more consumers encounter crypto through mainstream media, brands, exchanges, and financial institutions, perceived risk drops. Many simply assume that safety measures are now in place. People do not need to understand the technology to trust the experience, just as they do not need to understand card networks to trust card payments.

Regulatory signals have also helped, at least for those who are plugged into and sensitive to the topic. There is no full clarity, but there is enough stability that more adventurous consumers no longer feel they are stepping into a legal grey area when they pay.

How consumer crypto payments play out over the next 12 months

Adoption will be uneven and context-specific.

Consumers will not abandon cards wholesale. They will choose crypto when it is clearly better in their experience: international purchases, travel, digital goods, high-fee categories, frequent and trusted retailers (including local coffee shops, larger chains, and grocery stores), and locations where the point-of-sale experience is optimized.

At the point of sale, crypto payments will feel increasingly like another wallet option rather than a statement. Tap, scan, confirm. The novelty disappears quickly once the flow is familiar.

Online, crypto payments will win where speed, transparency, and global reach matter more than deferred credit or rewards schemes. Younger consumers and frequent cross-border shoppers will lead, but not exclusively.

Crucially, many consumers will use crypto without framing it as “crypto.” They will think in terms of balances, wallets, and instant payments. The underlying rail will be incidental.

What still must be unlocked for consumers

Putting aside edge cases of high adoption, several conditions must be met for mass consumer crypto payments to scale.

- Complexity must be hidden entirely. No chain choices. No fee tuning. No mental overhead. The system must make the correct choice on the user’s behalf.

- Security and trust must be explicit. There must be clear confirmation, clear recourse, and clear recovery paths. Consumers need confidence that mistakes are not fatal. They will not read whitepapers or dive into the technology, but as early adopters gain experience, the wider population will follow, based on history, media coverage, and friends’ anecdotes.

- Authentication has to be fast and familiar. Biometrics, device trust, and contextual approval should replace passwords, PINs, and additional manual steps.

- Transparency matters more than education. Consumers do not want to learn how crypto works. They want to see what they are paying, what they will receive, and how to get help if something goes wrong.

The shift that actually matters

High-volume consumer crypto payments will not succeed just because they are new or cool.

They will succeed when they feel easier, cheaper, and simply ‘better’ for consumers. Incentives such as price, loyalty, and personalization will be the icing on the cake – and who doesn’t like icing on their cake.

As all of this comes together, online and at the till, behavior will change quietly but quickly. The future will arrive without anyone needing to argue about it or create complex rationalizations.

I’ll return to Gibson, and beg forgiveness from fans if I make a small and inelegant tweak to his great words: “The future is already here, it’s just not very evenly distributed – but it’s spreading fast”.